How to Improve Credit Score Fast (2026 Guide)

A Comprehensive Step-by-Step Guide for Beginners in India, USA & Globally

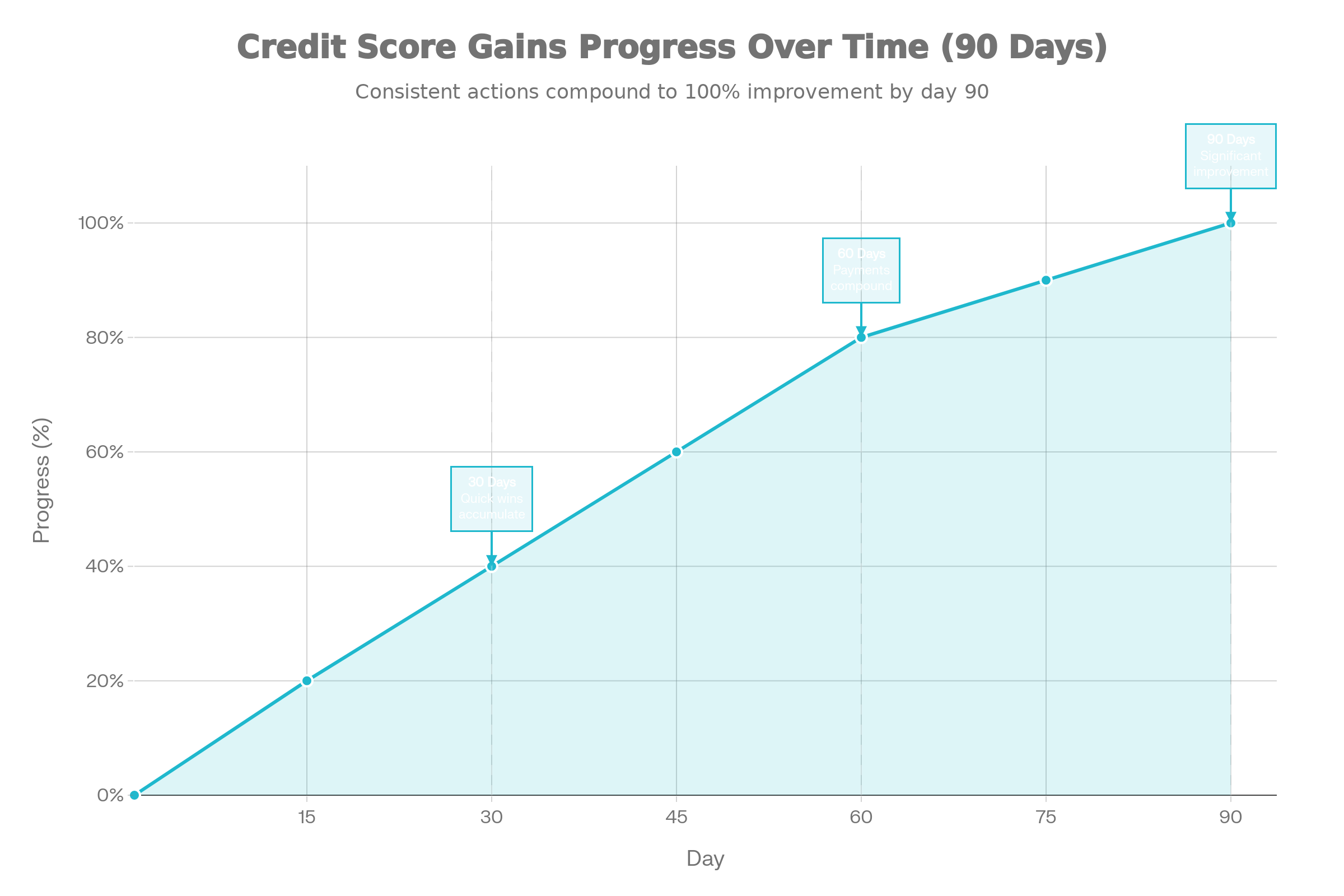

Quick Answer: You can improve your credit score within 30-90 days by paying bills on time, reducing credit utilization below 30%, and correcting errors on your credit report. However, significant improvements (50-100 points) typically require consistent action over 3-6 months.

Realistic Timeline: 30 days for quick wins (error corrections), 60 days for utilization improvements, and 90+ days for substantial score recovery.

What Is a Credit Score & Why It Matters

A credit score is a three-digit number (ranging from 300-900 in India and 300-850 in the USA) that represents your creditworthiness. It tells lenders whether you’re likely to repay borrowed money on time. Think of it as your financial reputation—the better your score, the more trustworthy you appear to financial institutions.

In India: Credit scores are provided by four bureaus—CIBIL, Experian, Equifax, and CRIF Highmark. A CIBIL score of 750 or above is considered excellent, while a score below 650 makes loan approval difficult.

In the USA: FICO scores (the most common) are the gold standard. Three major bureaus—Equifax, Experian, and TransUnion—report your credit history. A FICO score of 740 or higher is considered very good.

Real-Life Impact of Credit Scores

Loan Approvals: A score of 750+ dramatically increases your chances of loan approval and faster processing. A person with a 750 CIBIL score might get approved for a ₹10 lakh personal loan, while someone with a 650 score qualifies for only ₹3-5 lakhs.

Interest Rates: Higher scores mean lower interest rates. Someone with a 780 CIBIL score might get a personal loan at 9.99% p.a., while a person with 650 faces 15% p.a.—saving nearly ₹76,000 over the loan term.

Beyond Loans: Credit scores affect housing approvals, insurance rates, job prospects (for some employers), visa applications, and even rental apartment approvals. A good credit score is the foundation of financial freedom.

How Credit Score Is Calculated (With Percentages)

Credit scores aren’t random. They’re calculated using a specific formula that weighs five key factors. Understanding these will help you prioritize your actions.

| Factor | CIBIL (India) | FICO (USA) | Impact |

|---|---|---|---|

| Payment History | 30% | 35% | Most critical—missed payments hurt most |

| Credit Utilization Ratio | 25% | 30% | How much of your available credit you use |

| Credit Age & Mix | 25% | 25% | Older accounts and diverse credit types help |

| Hard Inquiries & New Credit | 10% | 10% | Too many applications in short time hurt |

| Credit Mix | 10% | 10% | Combination of secured & unsecured credit |

Breaking Down Each Factor

Payment History (30-35%): This is your payment track record. Did you pay on time? Were there any late payments, defaults, or collections? Even a single missed payment can drop your score by up to 100 points. Late payments remain on your report for 7 years, though their impact decreases over time.

Credit Utilization Ratio (25-30%): This is the percentage of available credit you’re using. If your credit card limit is ₹1,00,000 and you’ve used ₹30,000, your utilization is 30%. Keep this below 30% for optimal scores. Paying down balances is one of the fastest ways to improve your score (results visible in 30-60 days).

Credit Age & Mix (25%): This includes the age of your oldest account and a mix of different credit types. Older accounts are valuable—they prove you’ve managed credit responsibly over time. A mix of home loans, car loans, and credit cards signals you can handle diverse debt types. This factor improves naturally over time as you maintain older accounts.

Hard Inquiries & New Credit (10%): Every time you apply for credit, the lender performs a hard inquiry. Multiple inquiries in a short time signal desperation and lower your score temporarily. These inquiries stay on your report for 12 months but impact your score most heavily in the first 3 months.

Credit Mix (10%): Having a variety of credit—both secured (home loans, car loans) and unsecured (credit cards, personal loans)—shows you can manage different credit types responsibly.

Step-by-Step Plan to Improve Credit Score Fast

Don’t overwhelm yourself. Follow these actionable steps in order, and you’ll see measurable improvement within 30-90 days.

Download your free credit report from your nation’s credit bureau. In India, visit CIBIL.com or use platforms like Ruloans, Poonawalla Fincorp, or CRIF Highmark (all free). In the USA, visit annualcreditreport.com.

Review carefully for errors: wrong names, incorrect account information, late payments you didn’t make, or accounts you never opened. Errors are common and can be corrected within 30-45 days, leading to immediate score improvement.

If you find inaccuracies, file a dispute with the credit bureau. Send a formal letter with supporting documents (screenshots, bank statements, etc.). The bureau has 30 days to investigate and correct. Fixing errors alone can boost your score by 20-50 points.

Don’t focus on large debts first. Clear small, unpaid amounts across multiple accounts. Paying off even ₹2,000-₹5,000 balances demonstrates active debt management and improves your utilization ratio faster.

The psychological win matters too—you’re building momentum. Update your credit report 30-60 days later and see the improvement.

This is the fastest way to improve your score (visible in 30-60 days). If you have a ₹1,00,000 credit card limit and ₹50,000 balance, reduce it to ₹25,000 or below.

Strategy: Make multiple payments throughout the month, not just at month-end. This helps even if billing cycles don’t align.

Never miss a payment again. Enable auto-debit for all bills—EMIs, credit card minimums, utilities, phone bills, everything. Missing one payment can drop your score 100 points; being late by just one day counts as a miss.

Alternative: Set phone reminders 3 days before due dates.

If possible, pay the full amount due each month, not just the minimum. This keeps utilization at 0% for that month and avoids interest charges. If you can’t pay full, pay as much as possible to keep utilization under 30%.

Ask a family member or friend with excellent credit to add you as an authorized user on their credit card. Their payment history and low utilization will reflect on your credit report within 30-60 days, giving your score a quick boost.

Each hard inquiry drops your score 5-10 points temporarily. Don’t apply for new loans, credit cards, or personal loans for at least 3 months while you’re building. This is crucial during your recovery phase.

Don’t close old credit cards or loan accounts. Closing an account reduces your available credit and shortens your credit history—both hurt your score. Instead, keep them active with occasional small purchases and timely payments.

The most powerful factor. Make every single payment on time for the next 6 months, 1 year, and beyond. After consistent on-time payments for 3-6 months, you’ll see noticeable score improvement (50-100 point jumps). After 2 years of perfect payment history, your score can be excellent (750+).

Realistic Timeline – 30, 60, 90 Days

Credit improvement isn’t instant, but it’s faster than most people think. Here’s what to realistically expect:

What improves: Error corrections finalize, small debt payoffs reflect, and you start building on-time payment history. Utilization might improve if you’ve paid down balances.

What to expect: Credit bureaus update bi-weekly (as of 2025 CIBIL reforms). You might see a 20-30 point jump if errors existed or you cleared small debts.

What NOT to expect: Massive score jumps. One month of on-time payments won’t fix years of bad behavior.

What improves: Reduced credit card utilization now reflects fully across reporting cycles. Your on-time payments show consistency. Debt payoffs appear on your report.

What to expect: If you’ve paid down credit card balances below 30%, expect a 30-60 point improvement. Combined with error corrections, you could jump 50-80 points from baseline.

Milestone: You might cross from “Fair” (650-699) to “Good” (700-749) range.

What improves: Three months of on-time payments build a strong pattern. Bureaus see you’re serious about credit. Additional debt payoffs reflect. Credit history length slowly strengthens if you’ve kept old accounts active.

What to expect: Total improvement of 50-100 points from your starting score. If you started at 600, you could reach 650-700. If you started at 700, you could hit 750.

Locked-in behaviors: Your automatic payments and bill reminders are now habits. You’re on the right track.

Common Mistakes That Hurt Credit Score

Avoid these pitfalls that can destroy your credit score and negate all your hard work:

Mistake 1: Missing Even One Payment (30-100 point drop)

A single missed payment can drop your score 100 points. Late payments stay on your report for 7 years. Being even one day late counts as a late payment. Set up auto-pay immediately. There’s no excuse for missing a payment in 2026.

Mistake 2: Maxing Out Credit Cards (20-50 point drop)

Using 100% of your credit limit signals financial stress. Keep utilization under 30% (below 10% is ideal). If you have a ₹1,00,000 limit, don’t spend more than ₹30,000.

Mistake 3: Paying Only Minimum Due (Ongoing harm)

Paying minimums keeps your balance high, increases utilization, and costs you massive interest (30-40% p.a.). It’s a debt trap. Pay as much as possible, ideally the full balance.

Mistake 4: Closing Old Credit Cards (15-25 point drop)

Closing accounts shortens your credit history and reduces available credit, raising your utilization ratio. Keep old cards active even if you don’t use them. Use them occasionally for small purchases and pay immediately.

Mistake 5: Applying for Multiple Credits in Short Time (10-30 point drop per application)

Each hard inquiry hurts temporarily. Applying for 3 loans in one month could drop your score 30-60 points. Space applications out by 3-6 months. Exceptions: Multiple mortgage/car loan applications within 2 weeks count as one inquiry (lenders understand comparison shopping).

Mistake 6: Ignoring Your Credit Report (Missed opportunities)

Many people have errors on their reports and don’t know it. Review your report twice yearly. You’re entitled to one free report annually from each bureau.

Mistake 7: Co-signing or Co-borrowing Carelessly (Joint liability)

If you co-sign or co-borrow a loan, you’re fully responsible. If the primary borrower defaults, your score suffers equally. Be cautious.

Frequently Asked Questions (FAQs)

A: Check your credit score quarterly (every 3 months) to monitor progress and catch errors. Checking your own score is a “soft inquiry” and doesn’t hurt your score. Credit bureaus update scores bi-weekly as of 2025, so checking monthly is also fine. Many banks now offer free FICO score access through their apps—take advantage of this.

A: Yes. Use a secured credit card (backed by a fixed deposit), make small purchases, and pay in full monthly. After 6-12 months of perfect payment history, you’ll have a credit score (starting around 550-600). A credit-builder loan is another option—you make payments into a savings account, and the lender reports your on-time payments. Becoming an authorized user on someone else’s credit card also helps build history faster.

A: No, paying off a loan is good. Your score might dip slightly (5-10 points) temporarily because you lose an active account, but it recovers quickly. The positive impact of zero debt outweighs this tiny dip. Don’t avoid paying off debt to “protect” your score—that’s a myth. Always pay debts as planned or ahead of schedule.

A: Missed payments stay on your report for 7 years, but their impact decreases over time. After 2-3 years of on-time payments following a missed payment, the negative impact reduces significantly. After 7 years, the entry disappears entirely. Don’t give up—consistent good behavior rebuilds your score.

A: Yes, 750+ is considered excellent and unlocks the best loan terms and interest rates. Below 650, loan approval becomes difficult. The ranges are: 300-549 (Poor), 550-649 (Average), 650-699 (Fair), 700-749 (Good), 750-900 (Excellent). For most financial goals, aim for 750+.

A: Yes. Credit scores depend on payment history, not income. As long as you can make minimum payments on time, your score will improve. You might have fewer borrowing options, but credit-builder loans and secured cards still work. Focus on consistent, on-time payments regardless of income level.

A: Avoid credit repair scams. Legitimate credit information (like accurate late payments) cannot be removed. Credit bureaus only remove information that’s inaccurate or outdated (after 7 years). You can file disputes yourself for free. The only legitimate service these companies provide, you can do yourself. Focus on building credit naturally through consistent payments.

A: No. Checking your own score is a soft inquiry and never hurts. Only hard inquiries (when lenders check your credit) impact your score. You can check daily if you want—it won’t affect your score. Most banks, credit apps, and bureaus now offer free score checks regularly.

Expert Tips & Free Tools to Monitor & Improve

Free Credit Score Checks (India)

- CIBIL.com: Official CIBIL score check (free annual report + paid monitoring)

- Ruloans.com: Free CIBIL score check without impact

- Poonawalla Fincorp: Free CIBIL check and improvement tips

- CRIF Highmark: Free score + detailed credit report

- Experian India: Free credit score and health tools

Free Credit Score Checks (USA)

- AnnualCreditReport.com: One free report/year from all three bureaus

- Experian: Free FICO score and monitoring

- Credit Karma: Free VantageScore (not FICO, but useful for trends)

- American Express MyCredit Guide: Free FICO score (no card required)

Budgeting Tools to Manage Payments

- Use your bank’s bill-pay feature for automatic EMIs

- Google Calendar or phone reminders for payment due dates

- Apps like Money Lover or YNAB to track spending and maintain utilization

- Spreadsheet: Track all debts, due dates, and payment amounts in one place

Expert Habits for Lasting Credit Health

- Automate Everything: Auto-pay protects you from memory lapses

- Monitor Monthly: Check your credit report for changes and errors

- Spend Below Your Means: Keep utilization low by not maxing cards

- Never Co-sign Lightly: You’re liable if they default

- Build Multiple Credit Types: Mix of cards, loans, and instalment payments looks good

- Stay Patient: Improvement takes time; fast credit-building is rare and risky

Final Credit Score Improvement Checklist

- Downloaded and reviewed my free credit report from the bureau

- Identified and disputed any errors on my report

- Paid off small outstanding debts (micro-balances)

- Reduced credit card utilization below 30%

- Set up automatic payments for all bills and EMIs

- Committed to paying full credit card balance (or as much as possible)

- Stopped applying for new loans/credit cards (for 3+ months)

- Kept old credit cards active with occasional purchases

- Asked a trusted contact about being an authorized user (if needed)

- Scheduled quarterly credit score checks to monitor progress

- Created a budget to ensure on-time payments always

- Educated myself on what NOT to do (common mistakes above)

Take Action Today

Your credit score determines your financial freedom. Start with Step 1 (check your report) this week. The compounding benefits of consistent, on-time payments will transform your financial life.

Conclusion: Your Path Forward

Improving your credit score is entirely in your hands. You don’t need a credit repair company or magic formula—just discipline, consistency, and the right strategy.

The bottom line: Within 30 days, you can fix errors and pay down small debts. Within 90 days, you can see 50-100 point improvements. Within 6-12 months of perfect payment history and low utilization, you can reach 750+.

Your credit score is a scoreboard of your financial responsibility. Every on-time payment, every dollar you pay down, every error you correct—it all matters. Start today. Review your report, set up auto-payments, and commit to the 10-step plan above. Your future self—and your wallet—will thank you.

Remember: Credit improvement isn’t a sprint; it’s a marathon. Stay the course, and in 2026 and beyond, you’ll enjoy better loan approvals, lower interest rates, and genuine financial peace of mind.